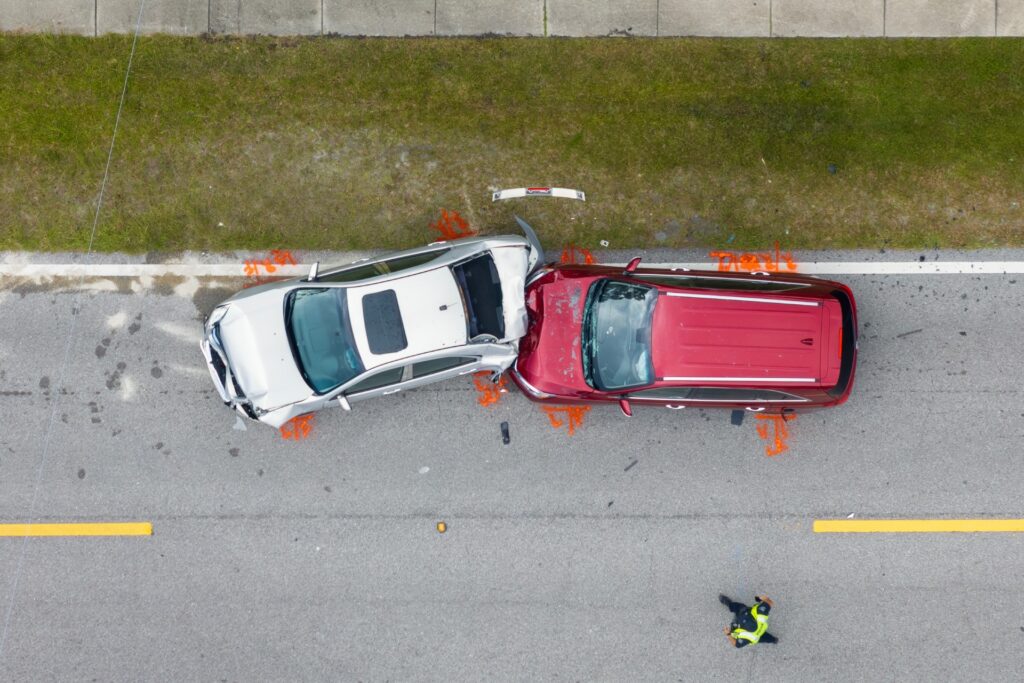

Few phone calls stop your day cold like this one: “I was driving your car… and… something happened.”

If you’ve ever faced a car accident in your own vehicle, but you weren’t driving it, you know the questions come immediately. Who pays? Whose insurance collision coverage applies? Are you personally exposed?

Florida’s insurance laws add another layer of confusion. The way coverage works here is not intuitive, and mistakes made early can cost you later.

This article breaks down what happens if someone drives your car and gets into an accident, how insurance typically responds, and when legal guidance can protect you from avoidable fallout.

What Happens If Someone Drives Your Car and Gets Into an Accident?

When someone gets in an accident while driving your car, the immediate priorities are safety and documentation. Emergency services should be contacted if anyone is injured, and police reports matter more than most people realize, especially when insurance questions arise later.

At the scene, responsibility is based on the actions of the person driving, not ownership of the vehicle. Still, the car owner is pulled into the process quickly. Insurance carriers will want to know who was driving, whether permission to drive was given, and what liability insurance coverage applies.

Be sure to promptly notify your insurer. Delays or incomplete information can complicate an already stressful situation and weaken your position if disputes follow.

How Does Car Insurance Work in Florida?

Before fault, before repairs, before lawsuits, Florida’s insurance rules set the direction of almost every car accident claim. Understanding how car insurance works in Florida helps explain why some claims move quickly while others turn into drawn-out disputes.

Florida’s No-Fault Insurance Rules Explained

Florida is a no-fault state. That means Personal Injury Protection (PIP) coverage typically pays for medical bills after a crash, regardless of who caused it. PIP applies first, but it does not cover everything, especially serious injuries or property damage.

Whose Insurance Pays When Someone Else Is Driving Your Car?

In Florida, car insurance usually follows the vehicle. That means the owner’s policy is typically the first to apply when someone else is driving your car and causes an accident. Coverage depends on whether the at-fault driver had permission and what the policy allows.

If damages exceed the owner’s coverage limits, your family member or friend’s car insurance policy may apply as secondary coverage.

Does Car Insurance Cover Someone Else Driving My Car?

This is where many Florida drivers get tripped up. Generally, an auto insurance policy follows the car, not the person. If you gave permission (explicitly or implicitly), coverage often applies. This is known as “permissive use.”

Problems arise when policies list excluded drivers, limit household members, or restrict certain uses of the vehicle. Family members, roommates, and frequent drivers can trigger coverage disputes if they were not disclosed on the policy.

If someone drives your car and gets in an accident outside permitted use, insurers may deny or limit claims.

Regardless, coverage is never automatic. The details matter, and insurance companies look for reasons to narrow their exposure.

What If the Driver Was at Fault in the Accident?

If someone gets in an accident while driving your car and causes the crash, liability becomes a central issue. Injured parties may pursue compensation beyond PIP, including claims for pain, suffering, and property damage.

Florida law allows lawsuits against both the driver and, in some cases, the vehicle owner if they can be held liable. Insurance companies evaluate fault aggressively because fault determines how much they pay, and whether they pay at all.

When damages go beyond policy limits, personal assets can come into play. This is where early legal guidance can make a measurable difference for both you and the person driving your car.

What If Someone Drives Your Car Without Your Permission and Crashes It?

Unauthorized use changes everything. If someone gets into an accident with your car without permission (such as a stolen vehicle or clear misuse), insurance companies may deny liability coverage outright.

Police reports become essential in these cases. Insurers will scrutinize whether permission was implied, whether keys were accessible, and whether the situation qualifies as theft. Disputes are common, and owners often find themselves defending claims they never expected.

Documentation and swift action matter here more than anywhere else.

When Should You Contact a Florida Car Accident Attorney?

Not every accident requires a lawyer, but many do. If you’re dealing with serious injuries, denied claims, unclear fault, or insurance pushback, hiring professional counsel early can protect you from long-term financial consequences.

These kinds of situations frequently turn adversarial once money is on the line. A Florida attorney will step in to handle insurer communications, clarify liability exposure, and prevent small mistakes from becoming costly ones.

Whether you’re seeking a Hialeah car accident attorney or Doral car accident attorneys, local knowledge carries real weight.

FAQs About Someone Else Driving Your Car in Florida

Is the car owner always legally responsible if someone else crashes the car?

Not always. Responsibility depends on permission, fault, and insurance coverage. Owners can still be pulled into claims, even if their friend or family member was the one driving.

Does my auto insurance go up if someone else wrecks my car?

It can. Insurers may view the claim as tied to your policy, even if you weren’t behind the wheel.

What happens if an uninsured driver crashes my vehicle?

Your policy may still apply, but gaps in coverage can leave you exposed. These cases often lead to disputes.

Can I be sued if someone else causes an accident in my car?

Yes. Florida law allows claims against owners in certain circumstances, particularly when damages exceed insurance limits.

Get Legal Guidance After a Car Accident Involving Your Vehicle

When someone else crashes your car, the consequences can follow you longer than the accident itself. Insurance companies move quickly to protect their bottom line, not yours—and unanswered legal questions about coverage, fault, and liability can leave you exposed.

If you’re dealing with this kind of accident and trying to understand whether insurance applies, DLE Lawyers will step in early to bring order to a confusing situation. A Miami car accident lawyer from our team will review the facts, deal directly with insurance policies, and explain where responsibility begins and ends under state laws.

Your consultation is free, and there’s no obligation. The sooner you get clear answers and legal representation, the more control you keep over what happens next.

Reach out to DLE Lawyers today to learn your next steps and determine who can be held responsible.